Special Report

By MYRNA M. VELASCO

October 10, 2011, 12:23pm

(First of two parts)

MANILA, Philippines — The era of cheap energy is over – that is gut-wrenching but it is already a given fact. And in the midst of all recent developments, renewable energy will be an inescapable component of the energy future.

That has been bandied about in energy circles and part of the truths long held by experts as a key factor that will help shape country-level or global energy policy agendas. Fast forward to 2030 until 2050, the cut of RE in the energy pie, according to experts will climb remarkably to 30-percent or higher. But the ascend, they infer, will be very gradual.

While traversing transition, two disconcerting concerns must be addressed here: one, at what pace would renewables (especially the unproven or emerging technologies) be integrated into the energy mix; and two, what will the consumers be able to afford?

Former Finance Undersecretary Romeo Bernardo, who is also vice chairman of the Foundation for Economic Freedom (FEF), explains that the economics of RE “is all about the allocation of limited resources, in this case, the consumers’ money over competing needs and wants.”

That is the same policy line being advocated by Energy Secretary Rene D. Almendras – that if the Department of Energy (DoE) is way too cautious on RE installations, because it has been putting the “consumers’ ability to pay” well into the equation.

To qualify, it is not as if the Philippines has been lagging behind in its renewable energy portfolio. With the existing geothermal and hydro facilities alone, the country already has the highest RE generation with a share of more than 30-percent in the power supply pie.

The ‘guilt tricks’ being employed by project developers to win RE acceptance are partly hinged on the calamities that struck us – that since Ondoy and Pepeng or Pedring and Quiel happened to us, we should embrace cleaner energy option, without question! Yet that needs closer examination. What about the clogged drainage system, forest denudation or unabated pollution from the transport sector? Without tracing the real problems, we might just have been eschewing the concrete solutions.

Mired in the rate hike mess

With reports that power rates in the Philippines are now highest in Asia, it becomes even more uncomfortable and irksome to anticipate that the line items (or the list of charges) in our electric bills will continue to get longer.

The widely-expected additions will not only comprise of the long-delayed universal charge recoveries of state-run power firms (i.e. the Power Sector Assets and Liabilities Management Corporation and National Power Corporation), but more importantly, the subsidies that will be levied to underpin the purported large-scale development of RE projects in the country.

Regulators and policymakers aptly termed these out-of-pocket subsidies (from consumers) as feed-in-tariff allowance (or FIT-All) – presumably, to stimulate acceptance of the added charges. Ultimately, that will be the line item that will be reflected in the bills – representing the peso-per-kilowatt hour (kWh) charge that will be collected from all end-users; which in turn, will be remitted to guarantee investment return for RE project developers.

Nevertheless, Mr. Bernardo emphasizes that “consumers need to know what they are going to pay, not just for the first set of FIT rates, but for subsequent ones also, which will add on, as the first batch is subsidized for 20 years.”

To be clear, there are specific FIT charges set per technology: P6.15 per kWh for run-of-river hydro; P7.00 per kWh for biomass; P10.37 per kWh for wind; P17.65 per kWh for ocean; and P17.95 per kWh for solar – based on the application of the National Renewable Energy Board (NREB) with the Energy Regulatory Commission.

Now, this is the tricky question – does RE integration in the country’s power mix would really fit all? There are various claims how the RE-FIT charges will impact in the electric rates (over the course of the 20-year lock-up period for the feed-in-tariff). Some project developers claim that renewable energy will eventually attain grid parity with conventional technologies. But all these assumptions, are considered to just have been based largely on “reading the tea leaves” – that said, such forecasts then may or may not happen.

I’ve heard about the ‘come-on lines’ on green jobs, clean alternatives and eventual price reductions. Yet if we take RE on face value as of today, global experts would concur that emerging RE technologies can’t be a solution yet to supply problems – and as the term “emerging” suggests, the technology is still unproven. So if project proponents would really want to gain acceptability of RE as an option, they’d better tackle the issues with honest responses to questions and straight-from-the-heart explanations why RE must be part of the choice for consumers – if not now, at least in the near future.

Race through forbidding terrain

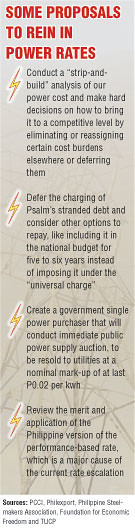

If gleaned from recent turn of events on the FIT deliberations at the ERC, it appears that the country’s RE policy will be getting a knock-out blow. Oppositions (er, reservations), due to its cost impact, have been coming from various sectors – including business groups such as the Philippine Chamber of Commerce and Industry (PCCI) and Federation of Philippine Industries (FPI), the country’s well-regarded economists at the FEF, Congress and even on concerns of readiness of the power utilities.

Based on technicalities alone, the public hearings on the FIT application have already been suspended twice. This has, so far, prompted ERC to declare that the 90-day approval process it previously cast in the FIT Rules may no longer be followed. What does that mean then? It could entail an uncertain outcome for the FIT rates – well, just maybe.

In the center of the fierce debates on RE rate impacts is “solar.” Suffice it to say that technologies are not created equal – and solar developers would just have to face the fact, that for now, their technology preference is still expensive, hence, it has been stirring up vicious objections.

The proposed FIT rates have also been caught up in the mess and politics of rising electricity rates in the Philippines. That shall compel NREB then to present a firmer justification if it has to make its way into having its proposed RE subsidies be approved.

“I always maintained that FIT granted to RE resources would not be a burden but rather a boon to consumers in the medium to long-term,” NREB chairperson Pete H. Maniego qualifies. He notes that based on the initial 760 megawatts of installations approved by the Department of Energy (DoE), the initial weighted average of the FIT rates would be P7.61 per kWh.

The counter-proposal of the FEF, is to prioritize instead the integration of RE based on a “least cost solution” – meaning, the cheaper technologies (i.e. hydro and biomass) must be developed first; and wait for the cost downtrend of the others (primarily solar) before they shall be integrated into the power mix.

“Perhaps the best way to do is to think along the lines of what a rational individual would do if it were his or her money. We look at what we can afford, which becomes a limiting factor,” Mr Bernardo asserts.

In the near-term, Mr. Maniego admits that RE would be more expensive as compared to traditional technologies in the mix – especially coal with prevailing rate of P5 per kWh. Coal being the country’s preference for baseload capacity, was used generally as the yardstick in NREB’s FIT calculations.

This is the NREB chairperson’s offer of hope to the cost-wary consumers: “once grid parity is reached, RE power cost would be lower than fossil fuel.” Grid parity would refer to the period when the cost of RE would equal or match the price of the conventional technologies, and RE advocates hinge on that for FIT to eventually be reduced substantially. When will that come? If NREB assumptions are correct, 6 to 7 years for the cheaper technologies. For solar, it still lurks in an uncertain future.

Without necessarily sounding too defensive, Mr. Maniego explains further that “NREB strictly adhered to the FIT Rules approved by the ERC which specified how the FIT rates should be determined... the assumptions and figures submitted by the RE developers were validated using DOE and ERC data, inputs from consultants and international standards.” The three-year periodic review of the FIT rates, is what he considers, one of the safeguards in the subsidy implementations.

NREB’s number-crunching, in general, has been anchored on assumptions that the cost of coal will rise steadily at 10-percent per annum, while the cost of RE will eventually become more stable and development prospects can be carried out on a more sustainable level.

Such premise, however, is being contested by experts and economists as they note that if referenced on historical swings in coal prices -- there have been cyclical downturns especially in cases of economic recessions such as what is being predicted now and on other debacles weighing down on energy demand growth. They emphasize that NREB categorically failed to factor in cyclical boom-and-bust episodes in the economy.

And as coal-generated electricity supplies are offered to buyers (off-takers) mostly on bilateral contracts, no prudent power utility will enter into a power supply agreement with a forbidding scenario of incessant double-digit rise in prices.

Schisms

RE developers assert that the feed-in-tariffs to be levied will only be subject to 4.0% inflation adjustment with no foreign exchange indexation on their fuel sources; while coal prices are seen climbing incessantly from now to 2030.

Following that line of reasoning, some covert facts may have been disappearing in the tall grass: what about the corresponding costs for substitute or reserve capacity when the wind doesn’t blow and the sun doesn’t shine? In the case of coal, if the 10-percent annual tariff adjustment is treated to be true, will that thrive as cost-proposition to offtaker-utilities? And what are the regulators doing?

Let us not also forget the other technology options in the mix. In the case of gas, it is a well-known fact that their prices are indexed to a basket of global crude grades – so if the uptrend in oil prices would continue, that is not a very favorable proposition either. Geothermal, despite its nature of on-site utilization and it being an indigenous clean source of energy, is also benchmarked on coal prices – using Australia’s Barlow-Jonker index. It just simply means then that whatever technology we choose, there will be risks involved. But for the sake of the consumers, good faith be damned if profit-motive rings louder.

Mr. Maniego concurs that “project costs of solar, ocean and wind power plants are still high at present,” yet he notes that the implementation of the RE Act must provide for wider-scale development of these emerging technologies, so their rates will turn more reasonable in the future.

He suggests that “the Philippines must invest in these technologies in the short-term to have the technical and operational capabilities once these technologies become competitive with conventional power.”

Apart from expensive technology costs, the very high risks of doing business in the Philippines have also been factored in by NREB in its FIT calculations. But would the Filipino consumers be really fleeced to the bones just to offer RE as an option for them? (To be continued)